The Gold Bug

Posted by Amit Bhandari on

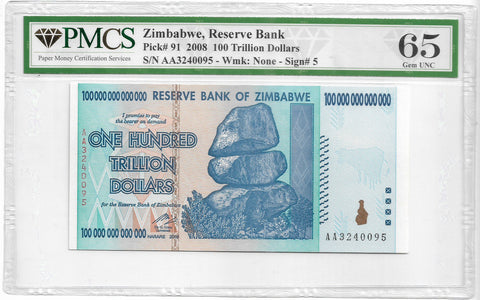

One of the first banknotes I picked up as a collector was the 100 trillion dollar banknote of Zimbabwe – practically worthless when it was printed; this note is now valuable as a collectible. This note is the best known instance of hyperinflation in the twenty-first century. While an outlier, the 100 trillion note highlights a major risk of fiat money – loss of value – which is far more common than we think. This note also helped me appreciate the traditional Indian love for gold – often criticized by economists and finance professionals. I also have in my collection gold and silver coins which are over 500 years old – and continue to hold their value.

Last week, Egypt ‘devalued’ its currency by nearly 40% against the US dollar – in other words, the Egyptian pound lost 40% of its value. In addition to higher prices, this is also a big hit to savers and investors – who will see a large part of their assets wiped out, overnight. Such one-way movements in fiat currencies are quite common. In December 2023, the Argentine peso was devalued by 54% against the US dollar. These devaluations were just reflections of market reality – the currency had already lost its value, the government acknowledged it after a long gap. In countries such as Pakistan and Turkmenistan, the official exchange rate is a farce. A large number of governments around the world feel that they can dictate exchange rates. When reality hits, savers and investors suffer.

The other big risk for savers is inflation – the Turkish lira for example, has lost 80% of its value against the US dollar over the past five years. Many of the advanced economies including the US and Germany have witnessed 8-9% inflation during 2022-23. The US Government has outstanding debt of $34 trillion – chipping away at this number steadily via inflation is always a temptation. This was the usual experience for Indian savers during the 1970s and the 1980s, when inflation was routinely in double digits. Holding gold was a much better bet than keeping money in the bank – where it would get taxed twice – inflation and income tax on interest income. Gold is immune to inflation and governments and central bankers hate it.